This chapter contains the following topics:

Introduction to Commission Codes

Printing Commission Code Lists

This chapter describes how to enter and print commission codes.

Commission codes do not apply if:

| • | You are not interfaced to the Order Entry (O/E) and Accounts Receivable (A/R) modules. |

| • | You have specified (in O/E Control information) that you do not use inventory item numbers for order entry. |

| • | You have specified (in A/R Control information) that you do not use sales representatives. |

| • | You have specified (in A/R Control information) that you employ sales representatives but do not pay them on a commission basis. |

| • | You do pay commissions, but you wish to decide the percent (or amount) of the commission without reference to the item number, either: |

-On the basis of the customer

-On the basis of the sale representative

-On a case-by-case basis.

If your situation falls into any of these categories, you can skip this chapter.

The Commission codes selection enables you to define different rules for computing commissions and assign a code to each rule. You can then associate this code (in Items) with individual items, so that the sale representative's commission is calculated automatically. This calculation is performed upon both:

| • | Invoice (entered in A/R) |

| • | Order (entered in O/E). |

Commission codes control the calculation of commissions not just on regular prices, but on override, sale, and contract prices as well.

You are not required to accept the calculated commission; you can always override it on individual documents.

| • | A commission is a payment which you make to your sales representatives based on the sales they generate. |

| • | Commissions only occur if you use sales representatives and if you choose that method of paying them. |

| • | A commission is a percentage of either the price or the margin (your choice). |

| • | Commissions become payable to the sales representative either when the invoice is posted or when payment has cleared (your choice). |

| • | Commissions may apply to either goods and/or services. |

| • | Commissions are calculated separately for each line item on a document (invoice or order), and the commission for the entire document is the sum of the individual line items. |

| • | When entering a document, for each line item, the operator must determine whether or not it is commissionable. |

If the line item is commissionable, the commission amount calculated for the line item is included in the total commission for this document.

If it is not commissionable, this line item does not contribute towards the total commission for this document.

The operator cannot alter the commission amount for an individual line item; he may only decide whether or not it is commissionable.

In deciding between commissionable and uncommissionable, the operator is given a default based on the characteristics of the customer, the item, or the sales representative. In most cases he need merely ratify this default.

After all line items have been entered, the operator can override the computed total commission, either by:

| • | Specifying a flat amount for the commission or |

| • | Providing a commissionable amount and a percentage for the document as a whole. The system extends these figures to obtain a commission total for that document (without attempting to allocate this total among the line items). |

Commission percents and calculation methods (price or margin) are associated either with each customer or with each sales representative (your choice).

These values are used to compute commissions for all service line items. If you do not use I/C inventory item numbers, they are also used to compute commissions for goods line items.

You define a system-wide default, which is automatically assigned to new entries when you do customer or sales representative maintenance unless you override this default in individual entries.

A line item is considered commissionable at the specified percentage whenever its customer or sales representative (whichever you have determined) possesses a non zero commission percent. Conversely, if you have not specified a percentage the line item is uncommissionable.

If you do use I/C inventory item numbers, then the default commissionability of a goods line item is determined by the presence or the absence of a commission code for that item.

A commission code identifies a rule or formula, defined by you, for varying the commission percent according to the price. This enables you to define different commissions for different items, and also to grant a higher or lower commission percent for the same item depending on its price. Prices for an item may vary from one document to another because of price codes, customer discount, sale pricing, or contract pricing; or simply because the user has supplied a one-time override price.

When you use I/C inventory item numbers, the commission percentage assigned to the customer or sales representative is ignored in computing the commission for that line item.

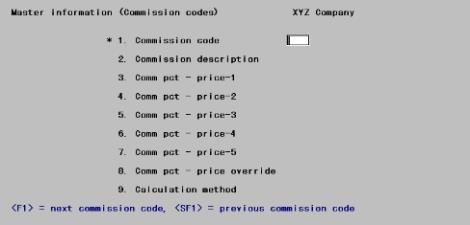

Select

Commission codes from the Master Information menu.

The following screen displays:

From this screen you can work with both new and existing commission codes. Enter the information as follows:

*1. Commission code

Options

Enter the commission code or use one of the options:

|

<F1> |

For the next commission code |

|

<SF1> |

For the previous commission code |

|

Format |

Up to two digits |

|

Example |

Type 3 |

2. Commission description

Enter the commission code description. The description will appear on the screen in the Orders, Billing, and Invoices selections.

|

Format |

Up to 25 letters |

|

Example |

Type Standard Commission |

Price-1 through Price-5

Enter in fields #3 through #7 the commission percentages to be paid for the corresponding price.

The price of each item is assigned in the Items selection. Prices are in descending order, with Price-1 being the highest. Your price structure may not use all five of these prices; if so, omit the unused prices.

The price actually charged may not coincide with any of an item's five prices, for several reasons:

| • | A customer line item discount may apply. |

| • | The price may be a sale, contract, or override price. |

| • | A price code may be in effect, which may cause the price to be discounted or marked up, or to be based on a cost rather than on any of the five prices. Refer to the Price Codes chapter for further information. |

In any of these cases, the system takes the price actually charged, computes the equivalent unit price, then compares the result with the five prices for the item and finds the one which matches best. It then picks a commission percentage corresponding to that price.

Note that any customer discount for the invoice (as opposed to line item discounts) is calculated only after all line items are entered, and therefore does not affect the selection of which commission percentage to use. However, both types of discounts are applied to the extended commission amount (otherwise the sales representative would be remunerated for revenue that has not actually occurred.)

3. Comm pct - price-1

Enter the commission percentage to be paid on items sold at or above price-1.

|

Format |

99.99 |

|

Example |

Type 8 |

4. Comm pct - price-2

Enter the commission percentage to be paid on items sold at or above price 2, but below price 1.

|

Format |

99.99 |

|

Example |

Type 7 |

5. Comm pct - price-3

Enter the commission percentage to be paid on items sold at or above price 3, but below price 2.

|

Format |

99.99 |

|

Example |

Type 6 |

6. Comm pct - price-4

Enter the commission percentage to be paid on items sold at or above price 4, but below price 3.

|

Format |

99.99 |

|

Example |

Type 5 |

7. Comm pct - price-5

Enter the commission percentage to be paid on items sold at or above price 5, but below price 4.

|

Format |

99.99 |

|

Example |

Type 4 |

8. Comm pct - price override

Enter the commission percentage to be paid on items sold at a price that is lower than the last price you have entered in fields #3 through #7 above.

Even if the maximum number of prices you have specified on any item in inventory is less than five, you should still specify a commission percent in this field, since it is always possible to enter an override price lower than the lowest price you have entered for the item.

|

Format |

99.99 |

|

Example |

Type 2 |

9. Calculation method

Enter P to calculate the commission amount based on the price, or enter G to calculate the commission amount based on gross profit (price minus cost). You may default to P by pressing <Enter>.

|

Format |

One letter, either P or G. The default is P. |

|

Example |

Press <Enter> to accept the default. |

At the Field number to change ? prompt you may modify a field or press <Enter> to accept the code as defined.

If at the first field you enter the number for an existing code, the screen display will be completed with the fields defined for the existing code. Make any needed changes, or use one of the options:

Options

Make any needed changes, or use on of the options:

|

<F1> |

For the next commission code |

|

<SF1> |

For the previous commission code |

|

<F3> |

To delete this commission code |

Commission codes can only be deleted in change mode. Before deleting any commission code, make sure that no item is still using that code, since the system does not test for this condition. If you enter an invoice (or order, or other document) for a line item containing a nonexistent commission code, no error message will be issued and the line item will be considered uncommissionable.

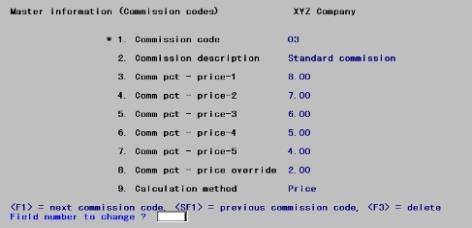

If you have been entering the suggested examples, the screen now displays similar to below:

In the example, if an item is sold at a unit price greater than price-2, but less than price-1, the commission is calculated as 7% of the price paid, and so on for the other price levels.

You may print a list of Commission Codes.

To print a list of Commission Codes, select Commission codes from the Reports, Master information menu.

Select

Commission codes from the Reports, Master info menu.